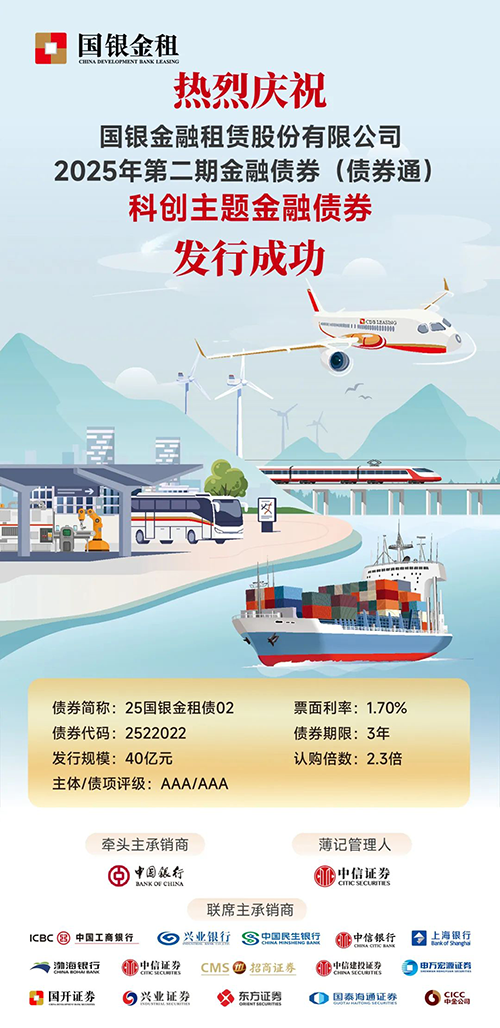

On July 17, China Development Bank Financial Leasing Co., Ltd. (CDB Leasing) issued the second tranche of 2025 financial bonds on China Interbank Bond Market under the Bond Connect Program. This tranche has an issuance size of RMB4 billion, with a maturity period of three years and a coupon rate of 1.70%, marking the largest single-tranche bond issuance among financial leasing peers since 2024, as well as the first “sci-tech innovation” financial bond issued by a leading lessor. The proceeds of the bonds will be used to replenish working capital, improve the liability structure of the Company, and strengthen the leasing products to serve the real economy, with a portion allocated to sci-tech innovation leasing projects to strengthen backing for the technological innovation sector. Amid historically low bond market yields,CDB Leasing capitalized on the issuance window, with the bond oversubscribed 2.3 times and achieving the lowest interest rate on record among financial leasing peers for issuances of comparable size. This outcome fully demonstrates its well-regarded image and leading market position. The Third Plenary Session of the 20th Central Committee of the Communist Party of China clearly outlined the need to accelerate the development of a multi-tiered bond market and establish a technology finance system aligned with technological innovation, so as to stimulate momentum for sci-tech advancement and market vitality, and contribute to fostering new quality productive forces. The successful issuance of the Company’s “sci-tech innovation” financial bond demonstrates its commitment to staying closely aligned with the core business of leasing, focusing on five major areas—namely, technology finance, green finance, inclusive finance, pension finance, and digital finance—and steadfastly following the path of financial development with Chinese characteristics, thereby consistently injecting financial vitality into the development of new quality productive forces.